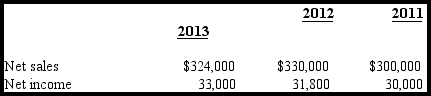

Prepare a trend analysis of the following data,using 2011 as the base year.Place your answers in the chart provided.Comment on the trend.

Definitions:

Proportional Rate Structure

A tax system where the tax rate is the same for all income levels, meaning everyone pays the same percentage of their income in taxes, regardless of how much they earn.

Legislative Regulations

are rules made by a government or regulatory body that have the force of law.

Progressive Rate Structure

A tax system where the tax rate increases as the taxable amount increases, resulting in those with higher incomes paying a higher rate of tax on their income.

Federal Income Tax

A tax levied by the U.S. government on the annual earnings of individuals, corporations, trusts, and other legal entities, based on their income levels.

Q41: On January 1,2013,Hilary Corporation acquired 100 percent

Q50: In a common-size income statement,each item is

Q63: Why is the quick ratio probably better

Q90: The receivable turnover and inventory turnover ratios

Q92: The stockholders' equity of Westester Corporation as

Q100: The information that follows pertains to stockholders'

Q143: Only sales to outsiders and purchases from

Q150: A corporation has<br>A) government regulations.<br>B) a limited

Q180: A company purchases 600 shares of its

Q186: Financial statement analysis can be both past-