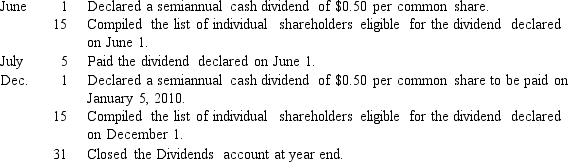

Mercer Corporation has 200,000 shares of $10 stated value no-par common stock authorized,and 160,000 shares were outstanding during 2012.The following transactions relate to cash dividends of Mercer Corporation for the year ended December 31,2012.Prepare entries in journal form without explanations to record the following transactions:

Definitions:

Endocardium

The innermost layer of tissue that lines the chambers of the heart.

Justification

The action or reason for defending or upholding a particular position, decision, or action, often by providing supporting arguments or evidence.

Extensive Reasons

Extensive reasons refer to a wide range of detailed explanations or justifications for an action, decision, or belief.

Request

An act of politely or formally asking for something.

Q21: Amortization<br>A)Enlargements of a plant's physical layout.<br>B)A right

Q22: Use this information to answer the following

Q38: Depletion<br>A)Enlargements of a plant's physical layout.<br>B)A right

Q77: The convertibility feature of a bond can

Q85: If a corporation has issued common stock

Q94: Cash inflows and outflows are not as

Q111: Speedy Printing purchased a new printing press

Q116: When a bond sells at a premium,what

Q133: Stock dividend<br>A)The maximum number of shares of

Q205: A truck that cost $12,000 and on