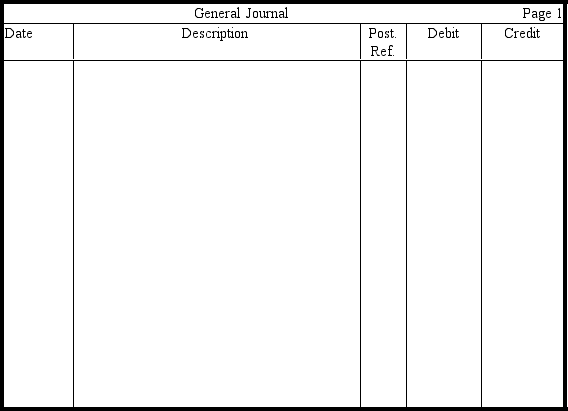

In the journal provided,prepare entries for the following independent transactions.(Omit explanations.)

a.Purchased land and a building on the land for $960,000.The appraised values of the land and building are $350,000 and $650,000,respectively.

b.Paid $5,000 for a sewage system,$15,000 for a parking lot,$1,000 to tear down a shack on land just purchased,and $10,000 for a block wall.

c.Purchased a truck two years ago for $18,000 with an original six-year estimated useful life and $3,000 residual value.After a full two years of use,revised the residual value to $4,000 and the useful life to a total of seven years.Record depreciation for year 3,assuming the straight-line method.

d.Purchased a machine on May 1,2013 (assume a calendar-year accounting period)for $15,000.The machine has an estimated life of 10,000 hours and no salvage value.Record depreciation for 2013 under the production method,assuming that the machine was used 2,000 hours.

Definitions:

British Colonists

Individuals from Britain who settled in various parts of the world, forming colonies that often became the foundation of modern nations.

Restrict Interaction

The act of limiting or controlling engagements or communications between individuals or groups.

Slave Workforce

The use of enslaved individuals as forced laborers, historically practiced in various parts of the world, including in the Americas, until the abolition of slavery.

Slave Conspiracies

Alleged or actual organized secret plots by enslaved people aiming to rebel or escape from slavery, often met with severe repression.

Q3: Zero coupon bonds

Q18: A commitment is recognized when the amount

Q43: When the trade-in allowance exceeds the carrying

Q106: Land and a building on the land

Q115: Estimated useful life<br>A)Enlargements of a plant's physical

Q128: A truck is purchased for $35,000.It has

Q173: Use this information to answer the following

Q181: Liabilities that might arise from which of

Q190: Use this information to answer the following

Q215: On January 1,2013,Belmont Corporation had 50,000 shares