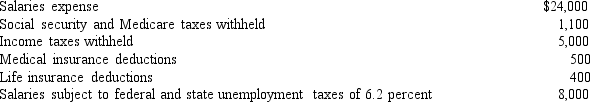

Use this information to answer the following question. The following totals for the month of July were taken from the payroll register of Greene Company: The entry to record the accrual of employer's payroll taxes would include a debit to Payroll Taxes and Benefits Expense for

The entry to record the accrual of employer's payroll taxes would include a debit to Payroll Taxes and Benefits Expense for

Definitions:

Pretax Financial Income

Pretax Financial Income is the amount of income earned by a company before taxes are deducted, as reported in its financial statements.

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government in a particular tax year.

GAAP

Generally Accepted Accounting Principles - a collection of commonly-followed accounting rules and standards for financial reporting.

Deferred Income Taxes

Taxes that are accrued but not yet paid or collected, often due to differences in accounting methods between tax regulations and accounting principles.

Q16: When depreciation rates are revised,only the remaining

Q19: If the net present value of a

Q59: The federal and state unemployment tax rates

Q90: Typically,depreciation calculations are rounded to the nearest

Q97: Which of the following is an example

Q127: Average inventory equals $200,000,and cost of goods

Q148: Goodwill equals the excess paid for a

Q148: The costs associated with coupons and rebates

Q151: A retail store has goods available for

Q156: Flint Corporation issues $1,000,000 of 30-year,8 percent