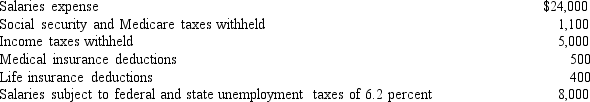

Use this information to answer the following question. The following totals for the month of July were taken from the payroll register of Greene Company: The entry to record the accrual of federal unemployment tax (assume FUTA tax of .8 percent) would include a

The entry to record the accrual of federal unemployment tax (assume FUTA tax of .8 percent) would include a

Definitions:

Operating Activities

Activities that constitute the primary or main activities of an entity, including cash flows from producing and delivering goods and providing services.

Noncontrolling Interest

An ownership interest in a company that is less than 50%, usually reflected as a separate component of equity on a parent company’s balance sheet, representing the portion of its subsidiaries not owned by the parent.

Dividends

Distributions made from a company's earnings to its shareholders, typically in the form of cash.

Consolidated Statement

A financial report that combines the financial results of a parent company and its subsidiaries, presenting the financials as a single entity.

Q10: Inventory turnover is a measure not expressed

Q11: The amount of property tax payable is

Q64: Assume that the $2,000,90-day,8 percent note was

Q68: Which of the following businesses most likely

Q71: The cost of land should include accrued

Q143: Securitization expedites the receipt of cash from

Q151: Montgomery Corporation has a 7 percent,$300,000 bond

Q206: If the purchase of machinery is treated

Q225: Under the successful efforts method,the costs of

Q234: Which of the following is not a