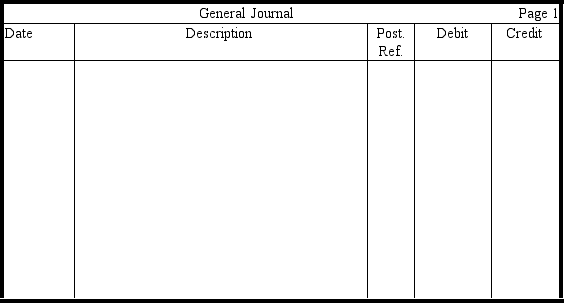

Assume that part of accounts and other receivables on Kittson Company's February 2,2010,balance sheet is comprised of $4,322,500 of notes receivable.Two notes make up the amount.The first note has a face value of $3,000,000 and bears interest at 7 percent for 90 days.The second note has a face value of $1,322,500 and bears interest at 9 percent for 120 days.Record the journal entry for the collection of the 7 percent note on May 3 and the dishonor of the 9 percent note on June 2.(Omit explanations; assume no interest had been accrued.)Round amounts to nearest dollar.

Definitions:

Sustainable Growth Rate

The maximum rate at which a company can grow its sales, earnings, and dividends without increasing its equity and by using internally generated funds.

Long-Term

Referring to a time period that extends beyond one year, often used in the context of investments, loans, or strategic planning.

Intermediate

A middle stage or level between basic and advanced.

Short

In finance, taking a position in which you sell a security you do not own, with the intention of buying it back at a lower price.

Q15: Return on assets is a measure of

Q15: Which of the following taxes is not

Q21: The higher the interest rate,the lower the

Q26: Each of the following is a characteristic

Q27: Liabilities generally arise from future transactions.

Q85: Calculate answers to the following questions using

Q94: Use this information to answer the following

Q117: A company's acceptance of credit cards like

Q125: The SEC requires companies to disclose the

Q158: Use this information to answer the following