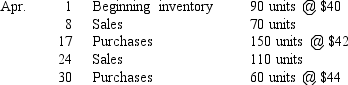

Use the following information to calculate cost of goods sold under each of three methods: (a)FIFO,(b)LIFO,and (c)average-cost.Assume the periodic inventory system is used.(Show your work.)

Definitions:

Variable Manufacturing Overhead

Costs in the manufacturing process that fluctuate with production volume, such as utilities and raw materials, which do not remain constant as production levels change.

Labor Efficiency Variance

The difference between the actual hours worked and the standard hours expected for the actual production achieved.

Direct Labor

The effort exerted by employees who are directly involved in the manufacturing process of products or delivering a service.

Padmaja's Labor

This refers to the labor costs associated with Padmaja, potentially singling out these expenses for a specific reason or analysis, considered direct or indirect labor depending on the context.

Q28: Using the following amounts taken from the

Q31: In periods of falling prices,FIFO will result

Q39: The cash basis of accounting results in

Q47: Advertising expense should be included in the

Q51: The Trial Balance and Adjusted Trial Balance

Q69: Jayne's Department Store had net retail sales

Q84: All factors in a future value table

Q89: Rogers Company sold merchandise worth $1,600 on

Q126: An estimated liability is a definite obligation

Q208: The manipulation of revenues and expenses to