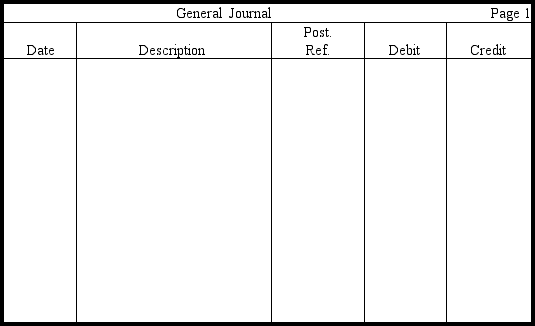

Assume that on July 24,Bond Company had a sale totaling $11,019 with a related cost of goods sold of $7,604.Record this transaction in journal form assuming the perpetual inventory system was in use.

Definitions:

Sum-Of-The-Years'-Digits

An accelerated depreciation method that applies a decreasing fraction to the depreciable cost of an asset over its useful life.

Depreciation Expense

An accounting method for allocating the cost of a tangible asset over its useful life, reflecting the asset's decrease in value over time.

Impairment Review

An examination of assets to determine if their carrying value exceeds their recoverable amount, potentially leading to an impairment loss.

Property, Plant

Property, Plant, and Equipment (PP&E) are long-term tangible assets used in the operation of a business and not intended for sale.

Q3: Which of the following accounts will have

Q36: In periods of rising inventory prices,the LIFO

Q37: Costs incurred in storing inventory usually are

Q59: Presented below are the Retained Earnings,Dividends,and Income

Q131: The continuity assumption acknowledges that estimates of

Q143: Which of the following actions can distort

Q162: The general ledger account for Accounts Receivable

Q186: In November,cash is received in advance of

Q212: The carrying value of equipment is the

Q217: The following steps in the accounting cycle