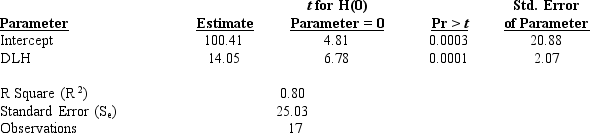

The following computer printout estimated overhead costs using linear regression:  Table of Selected Values: t Distribution

Table of Selected Values: t Distribution

What is the interval around Y if 95 percent confidence is desired?

Definitions:

WACC

stands for Weighted Average Cost of Capital, which is a calculation of a firm's capital cost from all sources, including equity and debt, weighted accordingly.

Capital Asset Pricing Model

A model used to determine the theoretical rate of return of an asset, considering risk and the time value of money.

Cost of Equity

The return a firm theoretically pays to its equity investors, i.e., shareholders, to compensate for the risk they undertook by investing their capital.

WACC

Weighted Average Cost of Capital, a calculation that reflects the cost of a company to finance its assets through a mix of equity and debt.

Q12: Exchange rate<br>A.The group of people who are

Q16: Refer to the figure.What is the cost

Q16: The following data pertain to the

Q62: Which of the following is an example

Q74: In regard to products,what is the definition

Q82: Which of the following transactions in a

Q101: What document identifies each product and accumulates

Q152: When a management accountant ignores data in

Q206: Which of the following is NOT a

Q221: Which of the following is a trait