On January 1, 2018, Vacker Co.acquired 70% of Carper Inc.by paying $650,000.This included a $20,000 control premium.Carper reported common stock on that date of $420,000 with retained earnings of $252,000.A building was undervalued in the company's financial records by $28,000.This building had a ten-year remaining life.Copyrights of $80,000 were to be recognized and amortized over 20 years.

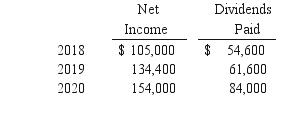

Carper earned income and paid cash dividends as follows:

On December 31, 2020, Vacker owed $30,800 to Carper.There have been no changes in Carper's common stock account since the acquisition.

Required:

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Definitions:

Trend

A general direction in which something is developing or changing, often identified through the analysis of data over time.

Seasonal Trend

A pattern in data that repeats at regular intervals over time, typically within a year.

Indicator Variable

A variable that takes on values of 0 or 1 to indicate the absence or presence of a categorical effect that may influence dependent variables.

Seasonal Index

Seasonal index refers to a numerical value that is assigned to specific time intervals to measure the seasonal pattern or variation in a data set over a period.

Q25: What amount should have been reported for

Q29: What should an entity evaluate when making

Q41: Compute the amount of Hurley's equipment that

Q44: A business combination results in $90,000 of

Q51: What is the noncontrolling interest's share of

Q63: Prepare a proper presentation of consolidated net

Q64: Refer to the figure.How long does it

Q65: Refer to the figure.How long would it

Q104: Polar sold a building to Icecap on

Q112: On January 1, 2019, Cocker reacquired 8,000