On January 1, 2018, Vacker Co.acquired 70% of Carper Inc.by paying $650,000.This included a $20,000 control premium.Carper reported common stock on that date of $420,000 with retained earnings of $252,000.A building was undervalued in the company's financial records by $28,000.This building had a ten-year remaining life.Copyrights of $80,000 were to be recognized and amortized over 20 years.

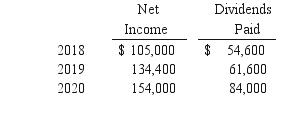

Carper earned income and paid cash dividends as follows:

On December 31, 2020, Vacker owed $30,800 to Carper.There have been no changes in Carper's common stock account since the acquisition.

Required:

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Definitions:

Exposure Therapy

A psychological treatment that involves confronting fears directly and in a controlled manner to reduce the fear response over time.

Phobias

Intense, irrational fears of specific objects, activities, or situations that lead to avoidance behavior.

Therapeutic Alliance

The collaborative relationship between a therapist and a client, which is crucial for effective therapy and positive outcomes.

Psychotherapy

A therapeutic treatment involving psychological methods, particularly when based on regular personal interaction, to help a person change behavior and overcome problems in desired ways.

Q16: Compute the goodwill arising from this acquisition

Q42: Waterhouse Company decreased the size of inventory

Q49: Compute the noncontrolling interest in the net

Q62: How are direct combination costs accounted for

Q65: Compute the amortization of gain through a

Q70: When Ryan's new percent ownership is rounded

Q77: What is the net effect on net

Q78: Compute the amount of Hurley's long-term liabilities

Q86: At the end of 2017, the consolidation

Q96: Which statement is true concerning unrecognized profits