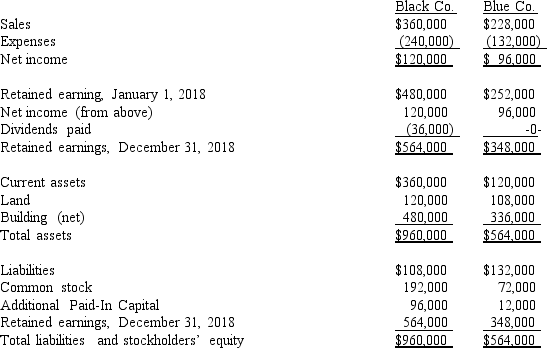

The following are preliminary financial statements for Black Co.and Blue Co.for the year ending December 31, 2018, prior to Black's acquisition of Blue Co.

On December 31, 2018 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue.Black's stock on that date has a fair value of $50 per share.Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000.Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.

On December 31, 2018 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue.Black's stock on that date has a fair value of $50 per share.Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000.Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2018.

Definitions:

Controversy

A prolonged public disagreement or heated discussion, often involving differing opinions or viewpoints.

Intrasender Role Conflict

A situation where an individual experiences conflicting demands or messages from the same source.

Synthetic Chemist

A scientist specialized in creating new compounds by synthesizing chemicals in a laboratory.

Lower Cost

Reducing expenses or the amount of resources required to produce goods or services, often to maintain competitiveness or increase profitability.

Q31: For each of the following numbered situations

Q34: Which of the following is not a

Q39: Compute the December 31, 2020, consolidated land.<br>A)

Q50: What was the balance in the Investment

Q53: Tosco Co.paid $540,000 for 80% of the

Q57: At what amount would consolidated goodwill be

Q67: Assuming there are no excess amortizations associated

Q82: How much goodwill is associated with this

Q104: X Co.owned 80% of Y Corp., and

Q108: On a consolidation worksheet, having used the