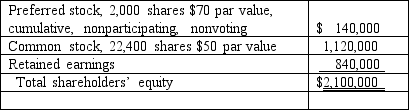

On January 1, 2018, Bast Co.had a net book value of $2,100,000 as follows:

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Definitions:

Contingency Approach

A management theory that suggests the most appropriate organizational structure or leadership style is dependent on specific external factors.

Culture-Performance Relationships

The dynamic interplay between the cultural norms and values within an organization and its performance outcomes.

Entrepreneurial Culture

An organizational environment that values innovation, risk-taking, and the pursuit of new business opportunities.

Job Security

The probability that an individual will retain their employment position without the risk of becoming unemployed.

Q25: Gibson Corp.owned a 90% interest in Sparis

Q27: Prepare a schedule to show the amount

Q57: Lechter Co.is preparing to issue stock.Its revenues

Q57: Compute consolidated land immediately following the acquisition.<br>A)

Q58: The partnership of Clapton, Seidel, and Thomas

Q64: Prepare the profit or loss test and

Q66: What amount will be reported for consolidated

Q70: In the consolidation worksheet for 2017, which

Q74: What amount will Coyote Corp.report in its

Q101: What is the partial equity method? How