Jet Corp.acquired all of the outstanding shares of Nittle Inc.on January 1, 2016, for $644,000 in cash.Of this consideration transferred, $42,000 was attributed to equipment with a ten-year remaining useful life.Goodwill of $56,000 had also been identified.Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary.

On January 1, 2019, Jet reported $280,000 in bonds outstanding with a book value of $263,200.Nittle purchased half of these bonds on the open market for $135,800.

During 2019, Jet began to sell merchandise to Nittle.During that year, inventory costing $112,000 was transferred at a price of $140,000.All but $14,000 (at Jet's selling price) of these goods were resold to outside parties by year's end.Nittle still owed $50,400 for inventory shipped from Jet during December.

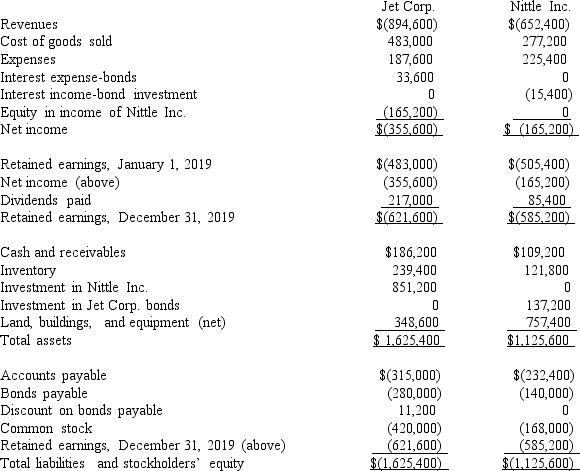

The following financial figures were for the two companies for the year ended December 31, 2019.

Required:

Required:

Prepare a consolidation worksheet for the year ended December 31, 2019.

Definitions:

Spices

Substances, often derived from plants, used to flavor or color food.

Homeostasis

The self-regulating process by which biological systems maintain stability while adjusting to conditions that are optimal for survival.

Set Point

A concept suggesting that the body regulates its weight and energy levels around a physiologically predetermined point, influencing appetite and metabolism.

Basal Metabolic Rate

The pace at which energy is expended by the body during rest to preserve critical activities such as respiration and temperature regulation.

Q10: How much difference would there have been

Q11: During a reorganization, how should interest expense

Q18: Belsen purchased inventory on December 1, 2017.Payment

Q25: Compute consolidated inventory at the date of

Q43: What is a proxy? Briefly explain the

Q59: EDGAR stands for:<br>A) Electronic Debits, Gains, Assets

Q63: Prepare a proper presentation of consolidated net

Q66: Flintstone Inc.acquired all of Rubble Co.on January

Q74: What is the net income attributable to

Q74: For what purpose is the SEC's Registration