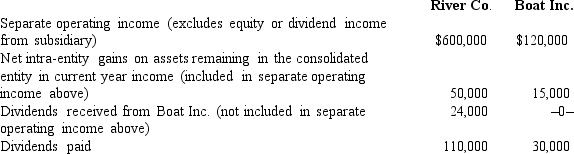

-What was the net income attributable to the noncontrolling interest, assuming that the separate return method was used to assign the income tax expense?

Definitions:

Date of Record

The specific date set by a company on which the shareholders must be on the company's books in order to receive a dividend.

Ex-Dividend

A stock trading term that denotes the timing of dividend payments – if you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment.

Declared Dividend

A portion of a company's earnings announced to be paid to shareholders on a specified date.

Homemade Dividend Policy

A strategy where investors create their own dividend stream by selling a portion of their portfolio of equities.

Q5: In an acquisition where 100% control is

Q20: Varton Corp.acquired all of the voting common

Q28: What two disclosure guidelines for operating segment

Q41: What is Ryan's percent ownership in Chase

Q52: What would differ between a statement of

Q60: What happens when a U.S.company sells goods

Q71: What Federal agency has Congressional authority to

Q92: When a company applies the partial equity

Q104: Polar sold a building to Icecap on

Q114: Which of the following statements is true