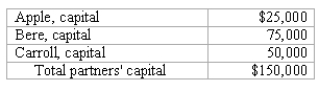

The partners of Apple, Bere, and Carroll LLP share net income and losses in a 5:3:2 ratio, respectively.The capital account balances on January 1, 2018, were as follows:  The carrying amounts of the assets and liabilities of the partnership are the same as their current fair values.Dorr will be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment.The amount of cash that Dorr should invest in the partnership is:

The carrying amounts of the assets and liabilities of the partnership are the same as their current fair values.Dorr will be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment.The amount of cash that Dorr should invest in the partnership is:

Definitions:

Buddhism

A spiritual tradition and religion founded on the teachings of Buddha, emphasizing the path to enlightenment through practices like meditation, ethical conduct, and wisdom.

Traditional Medicine

Healing practices and ideas based on indigenous beliefs and knowledge passed through generations, often involving natural remedies and treatments.

Complementary Alternative

Alternative approaches to healthcare and wellness that are used alongside traditional medical treatments to enhance overall health.

Adverse Effects

Unintended, negative reactions or side effects caused by a medication or treatment.

Q1: All of the following hedges are used

Q37: Prepare the journal entries for the dissolution

Q40: What are the four different ways IFRS

Q42: In the United States, foreign companies filing

Q42: How should the fresh start reorganization value

Q51: Turnaround Childcare Agency is a private not-for-profit

Q58: Generally accepted accounting principles require a U.S.corporation

Q78: C contributes $38,000 to the partnership and

Q80: What must Dilty do to ready the

Q99: What is Pi's accrual-based net income for