A U.S.company's foreign subsidiary had the following amounts in stickles (§) , the functional currency, in 2018:  The average exchange rate during 2018 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31, 2018 was §1 = $.84.At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2018 U.S.dollar income statement?

The average exchange rate during 2018 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31, 2018 was §1 = $.84.At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2018 U.S.dollar income statement?

Definitions:

Collectivistic Attribution

The tendency to attribute individuals' behaviors and success to their collective groups, emphasizing group goals over individual achievements.

Situational Attribution

Refers to attributing an individual's behavior to external or environmental factors.

Undependable

Not reliable or trustworthy; likely to fail or disappoint.

Fundamental Attribution Error

The tendency to overemphasize personal characteristics and underestimate situational factors when explaining others' behaviors.

Q9: A company is preparing financial statements using

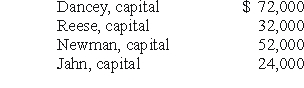

Q19: Before liquidating any assets, the partners determined

Q26: Which of the following is not a

Q31: The Wakefield Home incurred the following liabilities

Q47: If the assets could be sold for

Q59: On December 31, 2017, Carter Corp.a foreign

Q60: How much income tax expense is recognized

Q63: What was the purpose of the Securities

Q81: The trustor is the<br>A) Income beneficiary of

Q81: Which of the following costs require similar