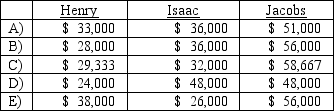

Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it.The noncash assets were then sold for $120,000.The liquidation expenses of $5,000 were paid prior to the sale of noncashassets.How would the $120,000 be distributed to the partners? (Hint: Either a predistribution plan or a schedule of safe capital balances would be appropriate for solving this item.)

Definitions:

Physical Count

A periodic inventory auditing process where a business physically counts its entire inventory to verify stock and identify discrepancies.

Perpetual Inventory System

A system of accounting that immediately logs the sale or acquisition of inventory using computerized point-of-sale systems and software for managing enterprise assets.

Freight Costs

Expenses associated with transporting goods from one location to another, often considered part of the cost of sales or inventory.

Refund Liability

Refund Liability refers to the obligation a company has to return funds to a customer for returned or rejected products or services.

Q4: Which items of information are required to

Q10: How is the presentation of a balance

Q25: What are the three broad sections of

Q33: Unconditional transfers of cash or other resources

Q40: Drye Township has received a donation of

Q42: Assuming the functional currency of the subsidiary

Q45: What is the amount of Adjustment to

Q53: To account for a forward contract cash

Q57: Which one of the following financial statements

Q69: What amount of foreign exchange gain or