An inter vivos trust was created by Isaac Posney.Isaac owned a large department store in Juggins, Utah.Adjacent to the store, Isaac also owned a tract of land that was used as an extra parking lot when the store was having a sale or during the Christmas season.Isaac expected the land to appreciate in value and eventually be sold for an office complex or additional stores.Isaac placed the land into a charitable lead trust, which would hold the land for ten years until Isaac's son would turn 21.At that time, title would be transferred to the son.The store will pay rent to use the land during the interim.The income generated each year from this usage will be given to a local church.The land was currently valued at $416,000.

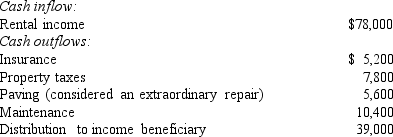

During the first year of this arrangement, the trustee recorded the following cash transactions:

Required:

Required:

Prepare all required journal entries for this trust fund including the entry to create the trust.

Definitions:

Normal Model

A normal model is a statistical distribution that is symmetric, bell-shaped, and describes how different variables are distributed, assuming that most occurrences take place around the mean.

Probability

A measure quantifying the likelihood that a specific event will occur, typically expressed as a number between 0 and 1.

Uniform Density

A measure indicating that mass is evenly distributed throughout a substance or object, so each unit volume has identical mass.

Probability

Probability refers to the measure of the likelihood that an event will occur, quantified as a number between 0 and 1, where 0 indicates impossibility and 1 indicates certainty.

Q1: Prepare the journal entry to record the

Q2: Assuming the functional currency of the subsidiary

Q2: What is consolidated net income?<br>A) $229,500.<br>B) $237,000.<br>C)

Q3: Simple City has recorded the purchase order

Q7: Which of the following statements is true

Q30: With respect to Nichols' investment in Smith,

Q57: Which item is not shown on the

Q63: What is the IOSCO?

Q70: An historical exchange rate for common stock

Q85: A parent company owns a controlling interest