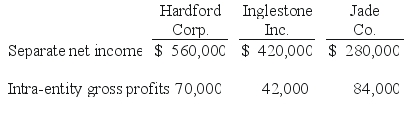

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:

-Which of the following statements is true regarding a subsidiary's investment in the parent company's stock?

Definitions:

Q14: With respect to the donations received in

Q22: Prepare a schedule to show the amount

Q23: According to U.S.GAAP, which of the following

Q40: Johnson, Inc.owns control over Kaspar, Inc.Johnson reports

Q48: A parent company owns a 70 percent

Q65: Compute the noncontrolling interest in the net

Q77: On January 1, 2018, a subsidiary bought

Q90: Gaw Produce Company purchased inventory from a

Q98: Stevens Company has had bonds payable of

Q102: Gentry Inc.acquired 100% of Gaspard Farms on