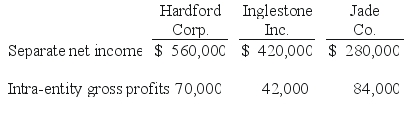

Hardford Corp. held 80% of Inglestone Inc., which, in turn, owned 80% of Jade Co. Excess amortization expense was not required by any of these acquisitions. Separate net income figures (without investment income) as well as upstream intra-entity gross profits (before deferral) included in the income for the current year follow:

-Compute the net income attributable to the noncontrolling interest in Ross for 2018.

Definitions:

Q2: In reporting consolidated earnings per share when

Q24: Panton, Inc.acquired 18,000 shares of Glotfelty Corp.several

Q24: Compute Whitton's accrual-based consolidated net income for

Q26: Prior to ASU 2016-14, what are the

Q45: What is the amount of Adjustment to

Q57: Which organization is responsible for establishing accounting

Q67: The acquisition value attributable to the noncontrolling

Q86: When consolidating a subsidiary that was acquired

Q103: Which of the following statements is true?<br>A)

Q120: Compute the amount of Hurley's buildings that