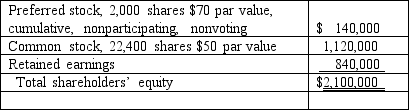

On January 1, 2018, Bast Co.had a net book value of $2,100,000 as follows:

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Definitions:

Q9: What amount of goodwill should be attributed

Q11: What choices does an executor of an

Q24: What is meant by "an individual dies

Q39: If Watkins pays $450,000 in cash for

Q41: Using the indirect method, where does the

Q57: Compute accrual-based consolidated income before income tax.<br>A)

Q61: Determine consolidated Additional Paid-In Capital at December

Q65: Compute the noncontrolling interest in the net

Q72: Which of the following will be included

Q116: When a parent uses the equity method