On January 1, 2018, Vacker Co.acquired 70% of Carper Inc.by paying $650,000.This included a $20,000 control premium.Carper reported common stock on that date of $420,000 with retained earnings of $252,000.A building was undervalued in the company's financial records by $28,000.This building had a ten-year remaining life.Copyrights of $80,000 were to be recognized and amortized over 20 years.

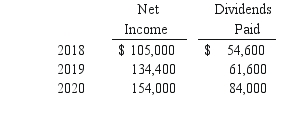

Carper earned income and paid cash dividends as follows:

On December 31, 2020, Vacker owed $30,800 to Carper.There have been no changes in Carper's common stock account since the acquisition.

Required:

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Definitions:

Labor Unions

Organizations representing the collective interests of workers in negotiations with employers over wages, benefits, and working conditions.

Surplus

The amount by which production, resources, or inventory exceeds the actual demand or use.

Labor

The human effort, both physical and mental, used in the production process to create goods or provide services.

Labor Unions

Organizations representing workers in various industries, advocating for better wages, working conditions, and benefits for their members.

Q7: On November 8, 2018, Power Corp.sold land

Q16: Assuming an additional savings account of $15,600

Q17: Fraker, Inc.owns 90 percent of Richards, Inc.and

Q21: Which of the following variable interests entitles

Q48: Which of the following statements is true?<br>A)

Q59: .Assuming at the time of death the

Q63: Vontkins Inc.owned all of Quasimota Co.The subsidiary

Q84: Compute the noncontrolling interest in Demers at

Q85: Dalton Corp.owned 70% of the outstanding common

Q98: Which of the following will result in