On January 1, 2016, Rand Corp.issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc.Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000.Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

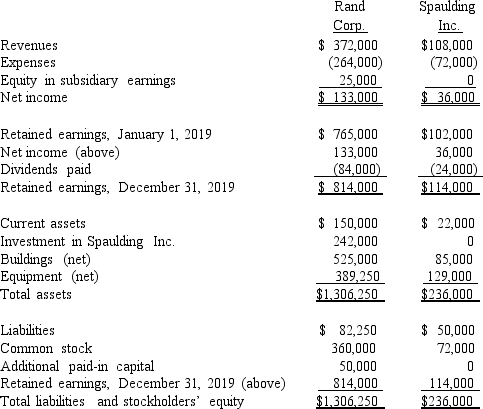

Following are the individual financial records for these two companies for the year ended December 31, 2019.

Required:

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Gesture

A movement of part of the body, especially a hand or the head, to express an idea or meaning.

Fair-Minded Interpretation

The objective and impartial explanation or analysis of information or events, free from bias.

Q15: Compute the December 31, 2020, consolidated total

Q24: What is meant by the term fiscally

Q32: Title to the residence was conveyed to

Q48: The executor of the estate of Yelbert

Q56: For an acquisition when the subsidiary retains

Q58: Compute the December 31, 2020, consolidated common

Q81: In settling an estate, what is the

Q94: What balance would Jaynes' Investment in Aaron

Q101: For acquisition accounting, why are assets and

Q101: What is the noncontrolling interest's share of