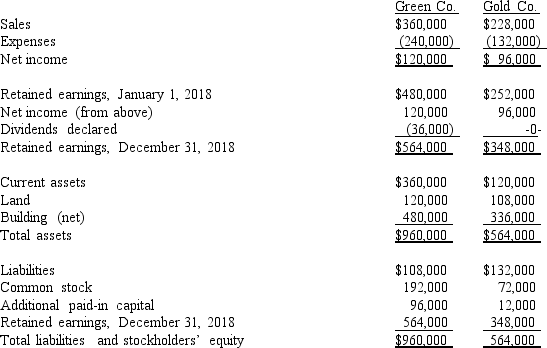

The following are preliminary financial statements for Green Co.and Gold Co.for the year ending December 31, 2018 prior to Black's acquisition of Blue.

On December 31, 2018 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

On December 31, 2018 (subsequent to the preceding statements), Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2018 after the acquisition transaction is completed.

Definitions:

Repressor

Transcription factor that slows or stops transcription.

X Chromosome Inactivation

Mechanism of dosage compensation: developmental shutdown of one of the two X chromosomes in the cells of female mammals. See also Barr body.

Calico Cats

A specific fur coloration in cats, characteristically with patches of red, black, and white.

SRY Gene

A gene located on the Y chromosome that is critical for the development of male physical characteristics.

Q10: How does a parent company account for

Q16: Compute goodwill, if any, at January 1,

Q18: What was Cleary's total share of net

Q26: What is the gain or loss on

Q29: What amount would the company have expected

Q36: What are the three goals of probate

Q42: Which statement is false regarding the Statement

Q52: Compute fair value of the net assets

Q75: The estate of Bobbi Jones has the

Q79: Compute the December 31, 2020 consolidated retained