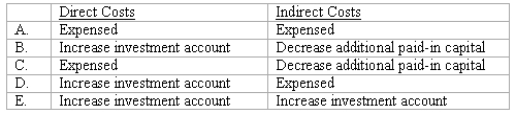

How are direct and indirect costs accounted for when applying the acquisition method for a business combination?

Definitions:

Producer Surplus

The difference between what producers are willing to accept for a good or service and the actual price they receive, reflecting extra benefit or profit.

Tax

Compulsory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Deadweight Loss

The reduction in economic productivity resulting from a failure to reach or the impossibility of reaching the market equilibrium for a particular product or service.

Excise Tax

A tax on specific goods or services, often with the goal of discouraging their use or generating revenue.

Q5: What events or circumstances might force the

Q17: Parent Corporation loaned money to its subsidiary

Q20: Which type of account would you assign

Q27: All of the following are acceptable methods

Q59: What should Dura Foundation report as program

Q71: Not-for-profit entities that are eligible to obtain

Q90: Under the partial equity method of accounting

Q93: In consolidation at January 1, 2019, what

Q95: Compute the consolidated additional paid-in capital at

Q120: Compute the amortization of gain through a