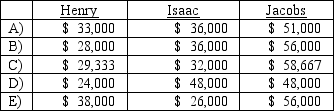

Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it.The noncash assets were then sold for $120,000.The liquidation expenses of $5,000 were paid prior to the sale of noncashassets.How would the $120,000 be distributed to the partners? (Hint: Either a predistribution plan or a schedule of safe capital balances would be appropriate for solving this item.)

Definitions:

Special Purpose Government

A form of government created for a specific, targeted purpose or project, often with a narrow scope of responsibilities compared to general-purpose local governments.

Legally Independent

A condition where an organization or individual functions autonomously, having distinct legal rights and obligations, without being controlled by or accountable to another entity.

Separately Elected

The process or state of being chosen or elected independently from others or through a separate procedure.

Proprietary Fund Types

Types of funds in governmental accounting used to account for activities similar to those found in the private sector, where the determination of net income is necessary or useful.

Q2: Assume that Bullen issued preferred stock with

Q20: What was the purpose of the Securities

Q26: What criteria must be met before a

Q28: Assume the functional currency is the U.S.Dollar;

Q32: Assume that noncash assets were sold for

Q44: According to GAAP, which of the following

Q52: Which of the following is a voluntary

Q69: Develop a predistribution plan for this partnership,

Q78: AChapter 7 bankruptcy is a(n)<br>A) Involuntary reorganization.<br>B)

Q94: A net liability balance sheet exposure exists