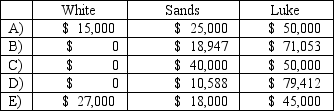

How would $90,000 be distributed?

Definitions:

Legal Forms

The various structures available for setting up a business or organization, such as sole proprietorship, partnership, corporation, and LLC, each with its own legal implications.

Government Funds

Financial resources provided by government agencies to organizations, including nonprofits, often for specific programs or projects.

Charitable Nonprofits

Organizations that operate for the public benefit and are exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code, focusing on charitable, educational, or religious purposes.

Section 501(c)(3)

Section 501(c)(3) refers to a portion of the U.S. Internal Revenue Code that grants tax-exempt status to nonprofit organizations that meet certain criteria, primarily those engaged in charitable, religious, educational, or scientific activities.

Q8: Anne retires and is paid $80,000 based

Q28: $520,000 of the $2,720,000 was expected to

Q39: A U.S.company has many foreign subsidiaries and

Q43: What was Nolan's capital balance at the

Q52: Which of the following is a voluntary

Q62: Jernigan Corp.had the following account balances at

Q90: Under the equity method, when the company's

Q94: A net liability balance sheet exposure exists

Q100: All of the following statements regarding the

Q102: When an investor appropriately applies the equity