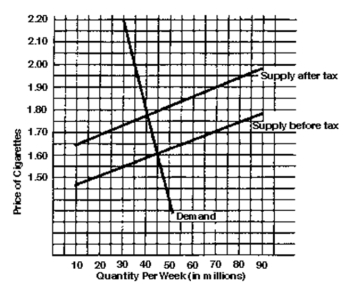

-How much is the tax?

Definitions:

Net Income

The amount of profit left after all operating expenses, taxes, and interest payments are deducted from total revenue.

Revenues

Revenues are the total income earned by a company from its normal business activities, before any expenses are deducted.

Expenses

Costs incurred in the process of earning revenue, typically categorized as certain costs necessary to operate a business.

Assets Increase

A rise in the company's resources, resulting from transactions that bring future economic benefits to the entity.

Q11: An elasticity of demand that would be

Q40: If the demand for table salt were

Q65: Which of the following can cause a

Q94: Statement I: It would be meaningless to

Q138: If the elasticity of demand for good

Q153: A drop in the price of oil

Q154: Which statement is true?<br>A)The supply curve in

Q175: The law of diminishing returns<br>A)applies only to

Q204: If elasticity of demand is 5 and

Q223: If price rises,<br>A)there may have been an