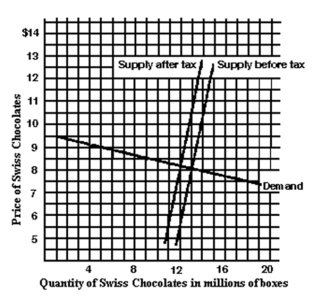

-About how much of the tax is paid by consumers in the form of higher prices?

Definitions:

Gradual Reinforcement

A process in operant conditioning where reinforcement is slowly introduced or varied to shape behavior.

Positive Reinforcer

A stimulus that, when presented after a behavior, increases the likelihood of that behavior occurring again.

Punisher

A stimulus or event that follows a behavior and decreases the likelihood of that behavior occurring in the future.

Conditioned Response

In behavioral psychology, the learned response to a previously neutral stimulus that has become conditioned.

Q24: When a tax is lowered this will<br>A)raise

Q35: If ATC is rising, MC<br>A)must be below

Q58: A decrease in supply is a decrease

Q78: As a person buys increasing amounts of

Q80: If the price of milk shakes were

Q113: How much is the tax?<br>A)$1.00<br>B)$1.50<br>C)$2.00<br>D)$2.50

Q113: The additional utility derived from consuming one

Q122: The supply curve slopes<br>A)upward to the right.<br>B)upward

Q164: The marginal cost curve intersects the ATC

Q243: If the market price is below equilibrium