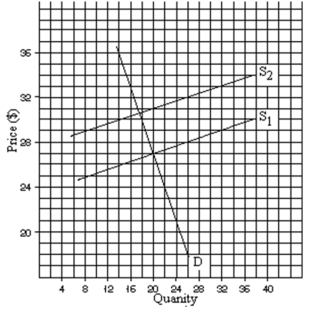

A.How much is the tax in the above graph?

B.How much of this tax is borne by the buyer and how much is borne by the seller?

C.As a result of the tax, by about how much does consumption fall?

Definitions:

Benefits-received Principle

The concept that individuals should pay taxes in proportion to the benefits they receive from government services.

Gasoline Tax

A levy imposed by governments on the sale of gasoline, used primarily to fund transportation initiatives.

Lump-sum Tax

A fixed tax amount not dependent on the taxpayer's income level or financial transactions.

Economic Efficiency

A state where every resource is optimally allocated to serve each individual or entity in the best way while minimizing waste and inefficiency.

Q3: Marginal utility is the _.

Q14: Which statement is false?<br>A)A product's utility to

Q32: If people have trouble selling their houses,

Q89: Marginal utility<br>A)is the usefulness a consumer derives

Q113: How much is the tax?<br>A)$1.00<br>B)$1.50<br>C)$2.00<br>D)$2.50

Q143: Draw a graph of AVC, ATC, and

Q180: The shutdown decision is made in the

Q207: Statement I: The demand curve slopes downward

Q209: If price were $6, there would be

Q236: Macy's spent $1 million to set up