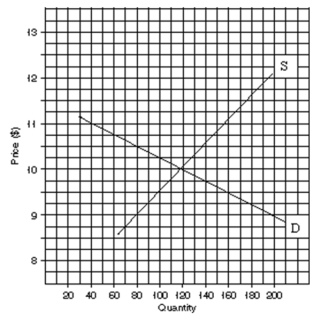

Draw another supply curve S to indicate a $1 tax increase. (a) How much of this tax is borne by the buyer? (b) How much of this tax is borne by the seller?

Definitions:

Bad Debts Expense

An expense reported on the income statement reflecting the cost of estimated uncollectible accounts receivable.

Net Credit Sales

Sales made on credit minus any sales returns or allowances, reflecting the actual credit sales revenue.

Uncollectible Accounts

Debts owed to a company that are considered to be uncollectable and are therefore written off as a bad debt expense.

Estimated Uncollectible

An accounting term referring to the portion of accounts receivable that a company does not expect to collect.

Q8: Which of these elasticities is the least

Q50: A change in the cost of production

Q72: The demand and supply curves cross at

Q75: Movement from the lower to the upper

Q120: If the quantities in the demand schedule

Q127: Which statement is false?<br>A)Rent control is a

Q146: Statement I: A perfectly elastic demand curve

Q176: Which statement is true?<br>A)Over time the supply

Q195: A decrease in supply is shown graphically

Q214: A firm that changes its price and