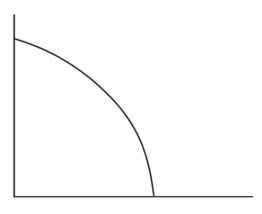

-Place point Z on the graph to indicate where our economy will most likely operate five years from now if we enjoyed an economic growth rate of 5 percent a year.

Definitions:

Modified AGI

An adjustment to Adjusted Gross Income (AGI) for specific items, affecting eligibility for certain tax benefits.

Qualified Expenses

These are specific expenses that meet criteria set by tax laws or other regulations for eligibility for tax benefits or deductions.

Finalized

To complete all required procedures to make a document or transaction officially valid and binding.

Child Tax Credit

A tax credit offered by the government which reduces tax liability for taxpayers with dependent children.

Q7: Which of the following would an economist

Q20: Which one of the following is not

Q36: Explain the benefits of incorporation.

Q37: Perrigo's return on equity (ROE)is closest to:<br>A)

Q40: In the mid-1980s, in which communist country

Q132: The form of economic system in Hitler's

Q142: The worst recession since the Great Depression

Q153: World War II veterans benefited from each

Q180: A country producing a combination of 5

Q206: If war breaks out and the economy