Use the following information to answer the question(s) below.

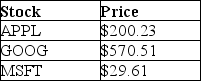

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of Apple Inc. (APPL) , one share of Google (GOOG) , and ten shares of Microsoft (MSFT) . Suppose the current stock prices of each individual stock are as shown below:

-Suppose that a security with a risk-free cash flow of $1000 in one year trades for $930 today.If there are no arbitrage opportunities,then the current risk-free rate is closest to:

Definitions:

Ratio Manipulation

Ratio manipulation is the practice of altering financial figures or ratios in a company's financial statements in order to present a more favorable image of its financial health or performance.

Financial Leverage

The use of borrowed funds to increase the potential return on investment, amplifying both gains and losses.

Profit Margin

A financial metric that measures the percentage of revenue that exceeds the costs of goods sold, indicating the efficiency in which a company turns sales into profits.

Sales

The total amount of goods or services sold by a company during a specified financial period.

Q6: If the current rate of interest is

Q21: Which of the following statements is false?<br>A)

Q39: Pfizer Inc.(PFE)stock is currently trading on the

Q51: When business firms get to be too

Q71: Which of the following statements regarding perpetuities

Q78: Which of the following statements regarding annuities

Q80: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q83: The dissolving of the _ in 1991

Q155: In 1790 the average farmer fed _

Q175: There are _ family farms today than