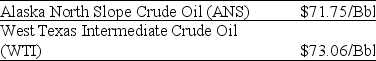

Use the information for the question(s) below.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

-Assuming you currently have 10,000 Bbls of WTI crude,the total benefits to you if you were to sell the 10,000 Bbls of WTI crude and use the proceeds to purchase and refine ANS crude is closest to:

Definitions:

Profitability Index

A measure used in capital budgeting to evaluate the profitability of an investment, calculated as the present value of future cash flows divided by the initial investment cost.

Discount Rate

The interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserve's discount window.

Q15: The NPV for project alpha is closest

Q25: According to the law of increasing costs,

Q44: Which of the following statements is false?<br>A)

Q49: The present value of receiving $1000 per

Q66: When using the book value of equity,the

Q68: Details of acquisitions,spin-offs,leases,taxes,and risk management activities are

Q75: Suppose that the ETF is trading for

Q79: The required net working capital in the

Q136: In 1937-1938, the number of unemployed<br>A)fell dramatically

Q156: According to the law of increasing costs,