Use the information for the question(s) below.

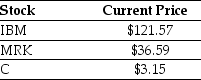

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM) ,three shares of Merck (MRK) ,and three shares of Citigroup Inc.(C) .Suppose the current market price of each individual stock are shown below:

-The price per share of the ETF in a normal market is closest to:

Definitions:

Extinction

The gradual weakening and eventual disappearance of a conditioned response when the conditioned stimulus is no longer paired with the unconditioned stimulus.

Successive Approximations

A behavior training process where closer and closer approximations to a desired behavior are reinforced until the desired behavior is achieved.

Shaping

A method of conditioning by which successive approximations towards a desired behavior are reinforced, gradually guiding the behavior closer to the target.

Contingency Management

A behavioral intervention strategy that modifies the consequences of behaviors to increase or decrease those behaviors.

Q2: A sole proprietorship is owned by<br>A) one

Q24: Consider a corporate bond with a $1000

Q34: Money that has been or will be

Q36: In terms of present value,how much will

Q37: If the risk-free interest rate is 10%,then

Q81: The firm's asset turnover measures<br>A) the value

Q194: Which statement is true?<br>A)There was brief depression

Q198: The recession of 1937-38 could be blamed

Q220: Statement I. There was a sharp recession

Q262: If the economy is at point R,