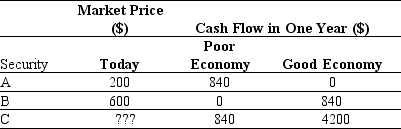

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

Definitions:

Normal Probability Distribution

A standard normal distribution, often used in statistics to represent real-valued random variables of unknown distributions.

Standard Deviation

A criteria used to determine the amount of spread or variation among a group of data values.

Negative Value

A number that is less than zero.

Standard Normal Distribution

A probability distribution that is symmetric about the mean, showing that data near the mean are more frequent in occurrence than data far from the mean, typically represented with a mean of 0 and a standard deviation of 1.

Q4: You are offered an investment that offers

Q13: Which of the following statements is false?<br>A)

Q14: Which of the following statements is false?<br>A)

Q29: The person charged with running the corporation

Q35: Consider an ETF that is made up

Q37: A 3 year default free security with

Q42: Dagny's monthly payments are closest to:<br>A) $1,110<br>B)

Q170: The suburbanization of America _ our dependence

Q215: The massive shift of population and industry

Q218: Of all the money spent on farm