Use the table for the question(s)below.

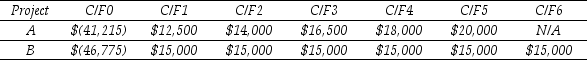

Consider two mutually exclusive projects with the following cash flows:

-If the discount rate for project B is 15%,then what is the NPV for project B?

Definitions:

Coin Flip

A method of making a decision or selecting between two options by tossing a coin and observing which side lands facing up.

Illusory Correlation

The mistaken perception of a relationship between two events or variables that are actually unrelated, often due to cognitive biases.

One-Shot Illusory Correlation

An illusory correlation that occurs after exposure to only one unusual behavior performed by only one member of an unfamiliar group.

Simulation Heuristic

A cognitive process in which individuals determine the likelihood of an event based on how easily they can imagine an outcome or scenario.

Q14: Rearden's equity cost of capital is closest

Q24: Consider a corporate bond with a $1000

Q25: The highest effective rate of return you

Q33: Accounts payable is a<br>A) Long-term Liability.<br>B) Current

Q40: The NPV for this project is closest

Q46: You are in the process of purchasing

Q70: The NPV for Boulderado's snowboard project is

Q72: The percentage change in the price of

Q73: If the interest rate is 7%,the NPV

Q97: Which of the following is false?<br>A)The completion