Use the information for the question(s) below.

Kinston Industries is considering investing in a machine that will cost $125,000 and will last for three years. The machine will generate revenues of $120,000 each year and the cost of goods sold will be 50% of sales. At the end of year three the machine will be sold for $15,000. The appropriate cost of capital is 10% and Kinston is in the 35% tax bracket.

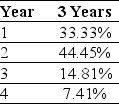

-Assume that Kinston's new machine will be depreciated using MACRS according to the following schedule:

What is the NPV of this project?

Definitions:

Compounded Monthly

Pertains to the frequency in which interest earnings are added to the principal investment amount, occurring every month.

Monthly Payment

Monthly payment is the amount of money paid each month towards the repayment of a loan, mortgage, or other financial obligation.

Loan

Money borrowed that is expected to be paid back with interest.

Compounded Annually

The calculation of interest on the principal sum of a deposit or loan, where the interest is added once per year.

Q8: If Firm A and Firm B are

Q10: Consider a corporate bond with a $1000

Q20: A company that manufactures copper piping is

Q34: Which of the following statements is false?<br>A)

Q49: The present value of receiving $1000 per

Q63: Which of the following statements is false?<br>A)

Q67: Which of the following statements is false?<br>A)

Q73: Which of the following statements is false?<br>A)

Q85: You want to maximize your expected return

Q90: Kinston Industries just announced that it will