Use the information for the question(s)below.

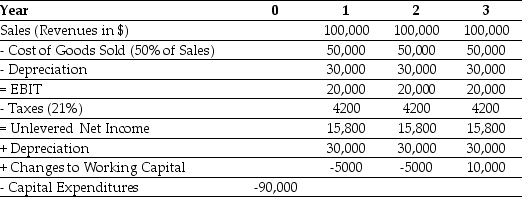

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projections:

-Epiphany would like to know how sensitive the project's NPV is to changes in the discount rate.How much can the discount rate vary before the NPV reaches zero?

Definitions:

Granodiorite

A coarse-grained igneous rock similar to granite but containing more plagioclase feldspar than orthoclase feldspar, commonly found in continental crust.

Marine Settings

Environments located in or influenced by the sea, including coastal regions and oceanic basins, characterized by specific ecological and sedimentological conditions.

Copper Deposit

An area of the Earth's crust containing a significant amount of copper, making it economically viable to mine.

Leaching

The process by which soluble substances are washed out from soil or wastes by the action of flowing water.

Q11: You are saving for retirement.To live comfortably,you

Q24: The present value of an investment that

Q26: The total market capitalization for all four

Q27: Perrigo's book value of equity is closest

Q35: Consider the following list of projects:<br> <img

Q38: Which of the following formulas regarding NPV

Q48: The excess return if the difference between

Q75: Assuming that costs continue to increase an

Q76: You are interested in purchasing a new

Q93: The beta on Paul's Portfolio is closest