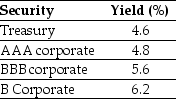

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The price (expressed as a percentage of the face value) of a one-year,zero-coupon corporate bond with a AAA rating is closest to:

Definitions:

Transparency

Refers to the openness and accountability in actions or decisions, often highlighting the necessity for information to be freely accessible.

Plagiarizing

The act of copying someone else's work or ideas and presenting them as one’s own without proper acknowledgment.

Stealth Marketing

A marketing strategy that advertises a product to people without them realizing they are being marketed to, thus avoiding overt brand exposure.

Multitask

The ability to perform multiple tasks or activities simultaneously.

Q1: If the YTM of these bonds increased

Q33: Which of the following statements is false?<br>A)

Q38: Which of the following formulas regarding NPV

Q39: The expected return on security with a

Q45: The cost of capital for a project

Q54: Which of the following statements is false?<br>A)

Q59: Which of the following statements is false?<br>A)

Q61: Suppose you plan on purchasing Von Bora

Q67: Consider a bond that pays annually an

Q92: Which of the following statements is false?<br>A)