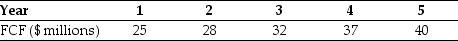

Use the information for the question(s) below.

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-If CCM has $150 million of debt and 12 million shares of stock outstanding,then the share price for CCM is closest to:

Definitions:

Specific Tariff

A fixed fee imposed on imported goods based on quantity, such as units, weight, or volume, rather than value.

Ad Valorem Tariff

A tax imposed on imported goods, calculated as a percentage of the value of the imports rather than a fixed rate.

World Price

The global market cost for a product or service, set by the overall demand and supply dynamics.

Baseballs

Spherical balls used in the sport of baseball, typically constructed from cork, rubber, yarn, and leather.

Q6: The NPV profile<br>A) shows the payback period

Q35: Assuming that this bond trades for $903,then

Q41: Which of the following is not a

Q43: The credit spread of the BBB corporate

Q46: Wyatt oil is considering drilling a new

Q56: Which of the following statements is false?<br>A)

Q67: Suppose the interest rate is 9% APR

Q91: Suppose the risk-free interest rate is 4%.If

Q92: Which of the following statements is false?<br>A)

Q104: The weight on Ball Corporation in your