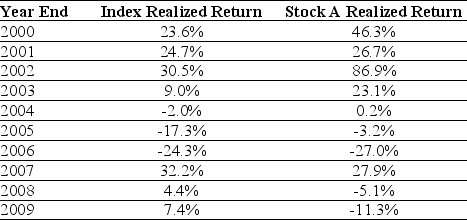

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on Stock A to forecast the expected future return on Stock A.The standard error of your estimate of the expect return is closest to:

Definitions:

Bond's Yield

The return an investor realizes on a bond, calculated as the interest or dividends received divided by the price of the bond.

Cost of Capital

The rate of return a company must earn on its investments to maintain its market value and satisfy its shareholders and creditors.

NPV

Net Present Value - a calculation used to assess the profitability of a project or investment by summing the present values of all cash flows associated with it.

IRR

Internal rate of return. A capital budgeting technique that rates projects according to their expected return on invested funds. The higher the return the better.

Q5: Portfolio "A"<br>A) has a relatively lower expected

Q17: The effective annual rate (EAR)for a savings

Q20: Which of the following statements is false?<br>A)

Q28: Using the data provided in the table,calculate

Q34: Rosewood's net income is closest to:<br>A) $450

Q41: Assume that you purchased Ford Motor Company

Q46: Which of the following statements is false?<br>A)

Q56: Which of the following statements is false?<br>A)

Q72: Suppose that Defenestration decides to pay a

Q77: You are considering adding a microbrewery on