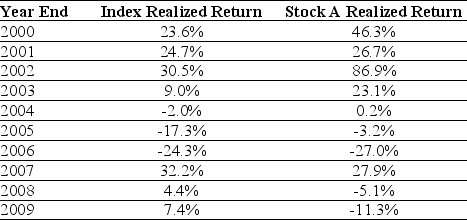

Use the table for the question(s) below.

Consider the following realized annual returns:

-Suppose that you want to use the 10 year historical average return on Stock A to forecast the expected future return on Stock A.The 95% confidence interval for your estimate of the expect return is closest to:

Definitions:

Q2: According to a survey of 392 CFOs

Q5: The weight on Taggart Transcontinental stock in

Q26: Rearden's expected capital gains yield is closest

Q26: Which of the following statements is false?<br>A)

Q29: Which of the following statements is correct?<br>A)

Q44: The effective annual rate for a credit

Q48: Which of the following statements is false?<br>A)

Q51: What is the excess return for the

Q61: Suppose you plan on purchasing Von Bora

Q63: Assume that you purchased J.P.Morgan Chase stock