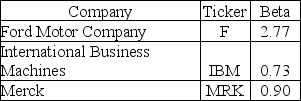

Use the following information to answer the question(s) below.

-If the expected return on the market risk 11% and the risk-free rate is 4%,then the expected return of investing in IBM is closest to:

Definitions:

Unexpected Wanted Event

A surprising occurrence that, despite being unforeseen, is welcomed or desired by those involved.

Normative-Stage Model

A theoretical model that suggests that human development proceeds through a series of predetermined, orderly stages.

Adult Personality

The combination of characteristics or qualities that form an individual's distinctive character in adulthood, shaped by developmental experiences.

Predictable Changes

These are alterations or developments that can be anticipated based on known patterns, historical data, or identifiable factors.

Q2: Suppose that California Gold Mining's expected return

Q7: A stock's _ measures the stock's return

Q28: The incremental after tax cash flow that

Q32: California Gold Mining's beta with the market

Q37: Suppose that Google Stock has a beta

Q38: Suppose that you borrow only $60,000 in

Q47: The payback period for project beta is

Q76: The payback period for this project is

Q89: Assume that in addition to 1.25 billion

Q116: The beta on Peter's Portfolio is closest