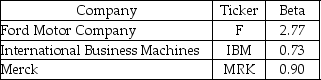

Use the following information to answer the question(s) below.

-If the risk-free rate is 5% and the expected return of investing in Merck is 11.3%,then the expected return on the market must be:

Definitions:

Class Exception

A type in many programming languages, notably Java, that represents errors or issues that occur during the execution of a program.

Division By Zero

An illegal operation in mathematics and most programming languages where a number is attempted to be divided by zero.

Integer Values

Numeric data types that represent whole numbers.

Catch Block

A section of code used in exception handling that defines what to do when a specific type of exception is thrown.

Q1: Which of the following statements is false?<br>A)

Q13: Which of the following statements is false?<br>A)

Q32: When all investors correctly interpret and use

Q46: The beta for security "Y" is closest

Q52: Equity in a firm with debt is

Q59: Which of the following statements is false?<br>A)

Q63: Assume that projects Alpha and Beta are

Q63: Which of the following statements is false?<br>A)

Q78: Which of the following statements is false?<br>A)

Q98: Assume that you purchased General Electric Company