Use the table for the question(s) below.

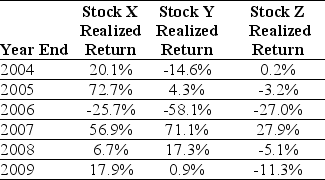

Consider the following returns:

-The variance on a portfolio that is made up of equal investments in Stock × and Stock Z stock is closest to:

Definitions:

Discriminant Validity

The degree to which a measurement tool is not correlated with variables from which it should theoretically differ.

Significant Correlations

Statistical relationships between two variables where the association is strong enough to not likely be due to chance.

Constructs

Abstract concepts or theoretical entities that are devised to explain patterns in research, such as intelligence, motivation, or happiness, which are not directly observable.

Interrater Agreement

The level of consistency among different observers or raters in the assessment or evaluation of the same phenomenon.

Q8: Taggart Transcontinental currently has no debt and

Q9: The amount that the price of bond

Q10: Suppose that if GSI drops the price

Q11: The Sharpe Ratio for Wyatt Oil is

Q20: Using the FFC four factor model and

Q29: Portfolio "C"<br>A) is less risky than the

Q49: Monsters' required return is closest to:<br>A) 10.0%<br>B)

Q59: Which of the following statements is false?<br>A)

Q87: Which of the following statements is false?<br>A)

Q109: Which of the following is not an