Use the table for the question(s) below.

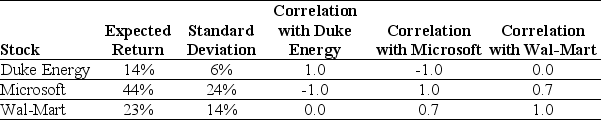

Consider the following expected returns, volatilities, and correlations:

-The volatility of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Intermediate Stage

This term refers to a middle phase in a process, development, or series, where significant progress has been made but the final goal has not yet been reached.

Idealize

To idealize is to regard or represent something as perfect or better than in reality, often ignoring possible flaws.

Grief

Grief is the intense emotional suffering or distress experienced as a result of loss, particularly the death of a loved one.

Caregivers

Individuals who provide care and assistance to those in need, such as children, the elderly, or the sick.

Q19: Which of the following statements is false?<br>A)

Q19: Which of the following statements is false?<br>A)

Q26: What is the Beta for a type

Q41: Consider a zero coupon bond with 20

Q45: Suppose that you want to maximize your

Q48: The excess return if the difference between

Q53: Assuming that Novartis AG (NVS)has an EPS

Q55: The Correlation between Stock X's and Stock

Q55: Which of the following statements is false?<br>A)

Q85: Consider the following equation:<br>E + D =