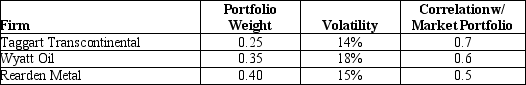

Use the following information to answer the question(s) below.  The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The Sharpe Ratio for the market portfolio is closest to:

Definitions:

Signs Of An Earache

Indicators of discomfort or pain in the ear, which may include tugging at the ears, fussiness, and trouble sleeping or hearing.

Tuberculosis Skin Testing

A test that determines if a person has been infected with the TB bacteria, involving the injection of a small amount of testing fluid into the skin.

Mantoux Test

A diagnostic tool for tuberculosis where a small amount of testing material is injected under the skin to see if there's a reaction, indicating exposure to TB bacteria.

High-Prevalence Regions

Areas or regions where a particular disease or condition is found more frequently than in other regions.

Q13: Suppose you plan on purchasing Von Bora

Q15: Assuming that Tom wants to maintain the

Q24: Consider the following formula: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="Consider

Q33: The b<sub>i</sub> in the regression<br>A) measures the

Q37: A 3 year default free security with

Q44: Considering the fact that Luther's Cash is

Q45: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1620/.jpg" alt="The term

Q53: Assume that you have $100,000 to invest

Q66: Assuming that Luther's bonds receive a AAA

Q74: Which of the following statements is false?<br>A)