Use the following information to answer the question(s) below.

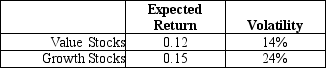

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

Definitions:

Elite Democratic

A model of democracy that posits that a small number of individuals, often from privileged socio-economic backgrounds, exert significant influence over political decision-making and policies.

Popular Democratic

Referring to a political ideology or movement that blends elements of democracy with a strong appeal to the general populace, focusing on the needs and desires of the common people.

Judicial Review

A legal principle that allows courts to determine the constitutionality of legislative and executive acts.

Original Meaning

The interpretation of the Constitution or law based on the intent and understanding of those who drafted and ratified it.

Q7: The expected return on the precious metals

Q32: If the Krusty Krab's opportunity cost of

Q53: Assuming that Novartis AG (NVS)has an EPS

Q56: Which of the following statements is false?<br>A)

Q61: Suppose you are a shareholder in d'Anconia

Q69: What is the Beta for a type

Q87: Which of the following statements is false?<br>A)

Q89: Which of the following statements is false?<br>A)

Q95: The NPV for this project is closest

Q120: The Sharpe Ratio for Rearden Metal is